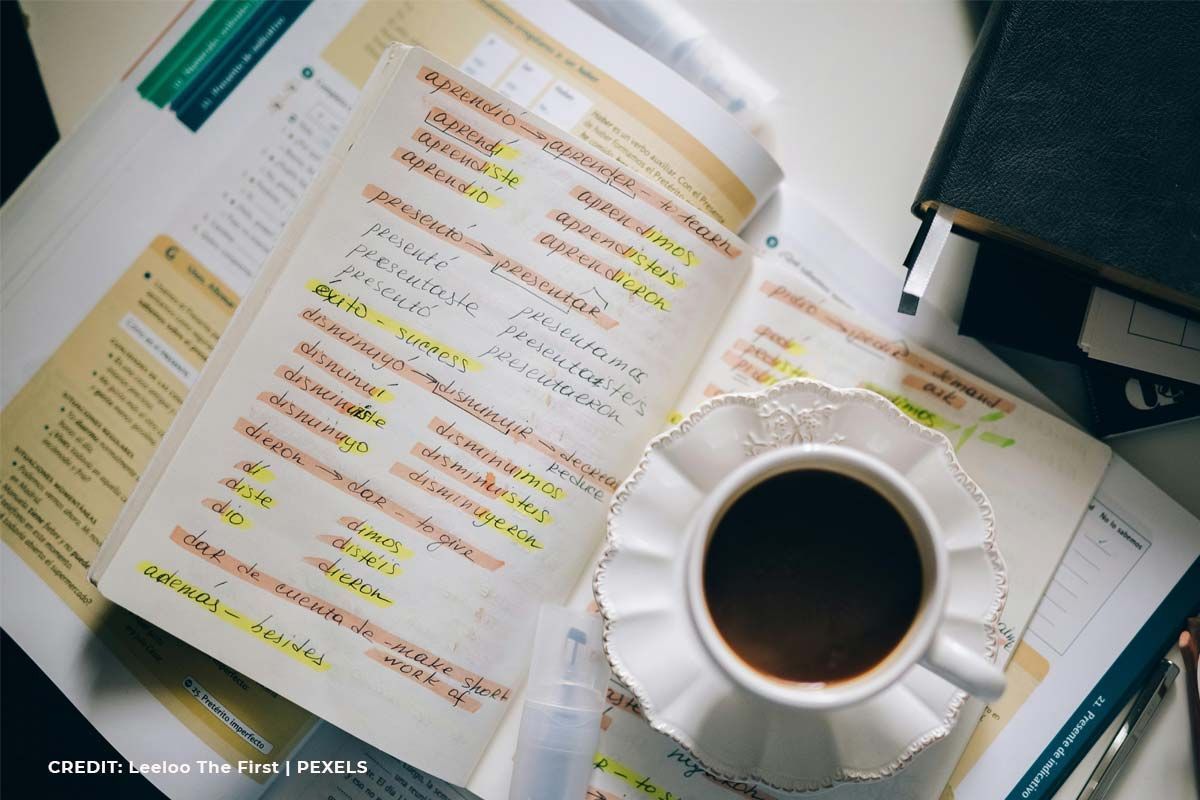

Language immersion: the dream of fluent communication, cultural understanding, and a broadened worldview—along with a host of other

cognitive benefits of learning a foreign language. It’s an adventure many embark on, picturing themselves effortlessly navigating foreign streets, engaging in lively conversations, and absorbing the local culture like a sponge.

However, the glossy brochures and enthusiastic testimonials often gloss over the less glamorous but equally crucial aspect of immersion—the hidden costs.

While the promise of fluency is enticing, failing to adequately budget for these often-overlooked expenses can turn your dream into a financial nightmare.

Beyond the obvious costs of tuition, accommodation, and flights, several factors can significantly impact your budget.

1. The Financial Toll of the Emotional Rollercoaster

Language immersion is an emotional rollercoaster. You’ll experience exhilarating highs when you finally understand a complex sentence, and crushing lows when you struggle to order a simple meal. This emotional strain can lead to impulsive spending as you seek comfort and distraction. You might find yourself splurging on familiar comforts from home, eating out more often than planned, or indulging in retail therapy to combat feelings of isolation.

Allocate a specific “emotional buffer” in your budget. This allows for occasional treats without derailing your entire financial plan. Consider engaging in free or low-cost activities like exploring parks, joining local language exchange groups, or utilizing free online resources for entertainment.

2. The Unexpected Expenses of Integration

Integrating into a new culture isn’t as seamless as it appears. You’ll encounter unexpected expenses related to cultural differences. For instance, you might need to purchase new clothing suitable for the local climate or social norms. You might also find yourself paying for translation services for official documents, or needing to hire a local guide to navigate bureaucratic processes.

Research the specific cultural norms and practicalities of your destination. Create a contingency fund for unexpected expenses related to integration, such as local transportation, visa extensions, or unexpected medical needs.

3. The Cost of Missed Opportunities and Delays

Adjusting to a new language and culture takes time. You might experience delays in completing tasks, miss out on local events due to language barriers, or encounter unforeseen obstacles that require additional resources to overcome. These delays can translate into lost income opportunities, increased living expenses, or the need for extended stays.

Factor in a “buffer period” for your immersion program. Don’t schedule your return flight immediately after your program ends. Allow yourself time to adjust and address any unforeseen issues. Also, if you plan to work remotely, expect productivity to decline initially.

4. The Hidden Costs of Communication

Staying connected with loved ones back home is essential, but it can be expensive. International phone calls, data roaming charges, and internet access can quickly add up. Furthermore, you might need to invest in a local SIM card, a VPN, or other communication tools.

Research affordable international communication plans. Utilize free Wi-Fi hotspots whenever possible. Consider using messaging apps that offer free calls and messages over the internet.

5. The Expense of Health and Well-Being

Your physical and mental health are paramount during language immersion. The stress of adapting to a new environment, coupled with changes in diet and routine, can take a toll. You might need to pay for unexpected medical consultations, prescription medications, or mental health support.

Ensure you have comprehensive travel insurance that covers medical expenses, including mental health support. Pack a first-aid kit and any necessary medications. Prioritize healthy eating, exercise, and adequate sleep.

6. The Financial Strain of Unforeseen Setbacks

Life happens, even during language immersion. You might experience theft, loss of belongings, or other unforeseen setbacks that require immediate financial resources. In such situations, accessing funds quickly can be crucial.

Have an emergency fund readily available. If you find yourself in a tight spot, explore options like an

easy loan. For those with less-than-perfect credit,

bad credit installment loans online might provide a solution.

7. The Cost of Returning Home

Language immersion is a transformative experience, but it requires careful planning and budgeting. By acknowledging the hidden costs and preparing for the unexpected, you can ensure a successful and enriching journey.

Ready to take the first step towards your language immersion dream?

Contact Lamina Brokers today at 1-844-356-5097 for personalized financial guidance and support. We can help you explore your options and find the right financial solutions to make your language immersion a reality.